boulder co sales tax return

Claiming credit for other city state or county tax on line 8. The Colorado state sales tax rate is currently.

Short Term Dwelling And Vacation Rental Licensing Boulder County

DR 0235 - Request for Vending Machine Decals.

. The Boulder sales tax rate is. Complete a Business License application or register for a Special Event License. 13 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax.

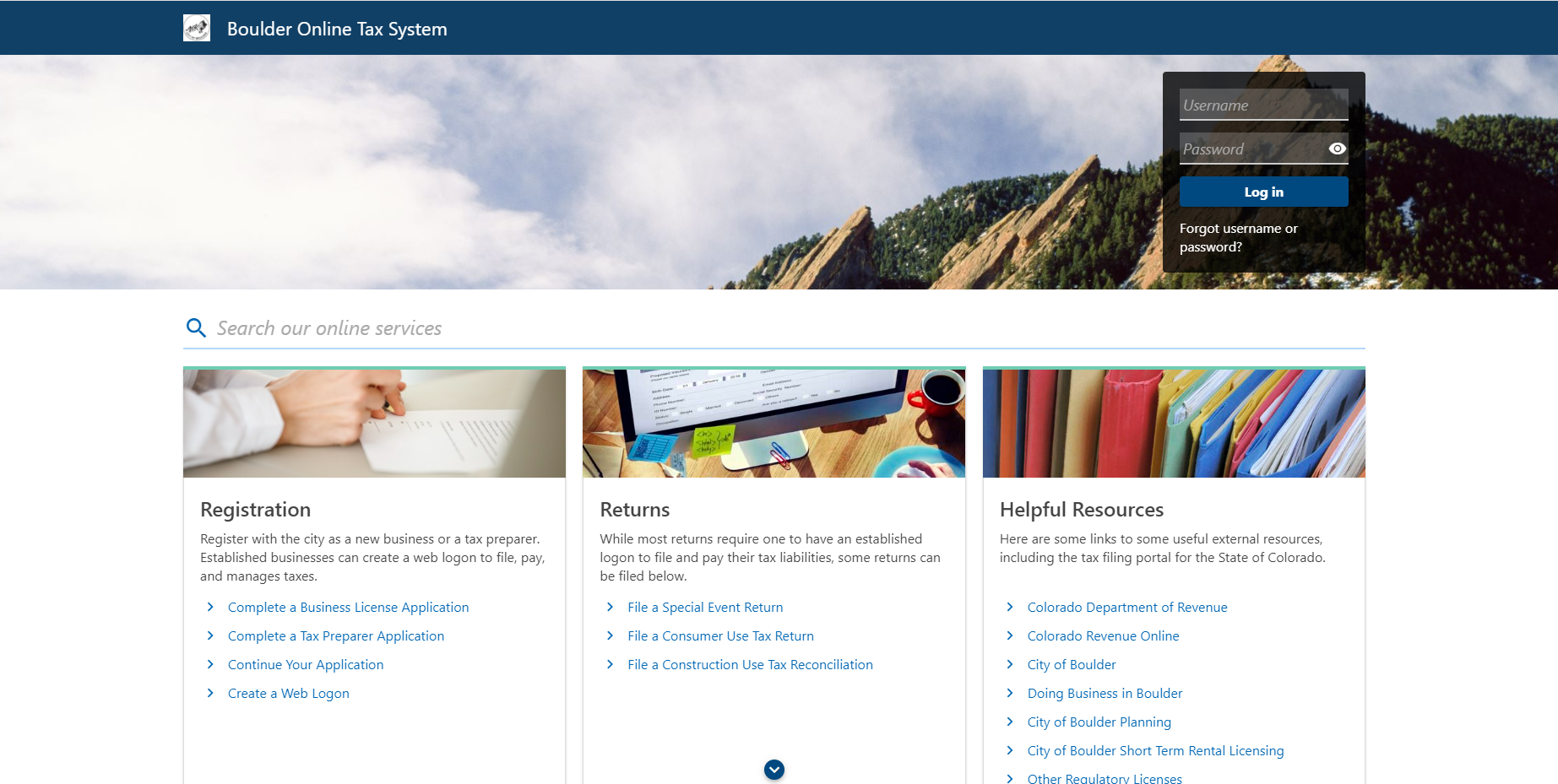

Use Boulder Online Tax System to file a return and pay any tax due. Sales Tax Return Instructions. Colorado Retail Sales Tax Return DR 0100 Colorado SalesUse Tax Rates DR 1002 Retail Food Established Computation Worksheet for Sales Tax Deduction for Gas andor Electricity DR 1465 Sales Tax Exempt Certificate Electricity Gas for Industrial Use DR 1666 Sales Tax Topics.

City of Boulder Sales Tax Division PO Box 791 Boulder CO 80306-0791 Phone. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now. The Colorado sales tax rate is currently.

Construction companies engaged in business in the City of Boulder in the capacity of a seller or user of tangible property and taxable services must obtain a sales and use tax business license and report and pay Boulder city tax through monthly quarterly or annual salesuse tax returns as noted in subsections 3-2-2a and 3-17-7c of the Code. The minimum combined 2022 sales tax rate for Boulder Colorado is. To review the rules in Colorado visit our state-by-state guide.

If you have more than one business location you must file a separate return in Revenue Online for each location. Sales tax returns may be filed quarterly. Automating sales tax compliance can help your business keep compliant with.

Enter you r business gross sales. CR 0100AP - Business Application for Sales Tax Account. If you cant find what youre looking for online contact Sales Tax staff at salestaxbouldercoloradogov.

Excess Tax Collected 000 7. 2A Enter any bad debts that had been written off but recently collected. There are a few ways to e-file sales tax returns.

Annual returns are due January 20. File online tax returns with electronic payment options. The Boulder County sales tax rate is.

15 or less per month. 2B This cell will self-calculate. With proof of payment sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular item.

Under 300 per month. Filing frequency is determined by the amount of sales tax collected monthly. Deductions enter as positive numbers.

Not including all taxable purchases materials and other tangible personal property in the taxable amount on line 4. Has impacted many state nexus laws and sales tax collection requirements. DR 0154 - Sales Tax Return for Occasional Sales.

6 rows For information related to specific tax issues for state county or RTD please contact the. The 2018 United States Supreme Court decision in South Dakota v. Sent direct messages to Sales Tax Staff.

Use tax is intended to protect local businesses against unfair competition from out-of-city or state vendors who are not required to collect City of Boulder sales tax. The city use tax rate is the same as the sales tax rate. Ad CO Sales Tax Return More Fillable Forms Register and Subscribe Now.

The combined rate used in this calculator 8845 is the result of the Colorado state rate 29 the 80303s county rate 0985 the Boulder tax rate 386 and in some case special rate 11. Common Problems with Reconciliation Returns. This is the total of state county and city sales tax rates.

The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to. DR 0100 - 2022 Retail Sales Tax Return Supplemental Instructions DR 0103 - 2022 State Service Fee Worksheet. Sales Tax Division DUE DATE.

Sales tax returns may be filed annually. DR 0155 - Sales Tax Return for Unpaid Tax from the Sale of a Business. The County sales tax rate is.

Visit the Boulder Online Tax System Help Center for additional resources and guidance. City of Boulder Sales Tax Form. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online.

Initial Use Tax Return. Sales 000 of line 4 000 000 5C. City of Boulder Department of Finance.

Amount of city FOOD SERVICE TAX 015 of line 5B 6. Sales Tax Calculator of 80303 Boulder for 2019 The 80303 Boulder Colorado general sales tax rate is 8845. Claiming credit for all permit fees and taxes on lines 6 and 7.

Get started with a sales tax boulder form 0 complete it in a few clicks and submit it securely. 3A Enter your non -taxable services and sales that are not included in the following section 3B -3J. 20 days following the opening day of your business Business Name.

For additional e-file options for businesses with more than one location see Using an.

How Cu Boulder Is Funded Budget Fiscal Planning University Of Colorado Boulder

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Taxes In Boulder The State Of Colorado

Construction Use Tax City Of Boulder

Finding The Right Real Estate Attorney For Lease Negotiation Consult Commercial Lease Review Attorney In Boulder Co Real Estate Negotiation Attorneys Lease

Getting Your Business Established In Boulder Colorado

Sales Tax Campus Controller S Office University Of Colorado Boulder

Pin By University Of Colorado Boulder On Resume And Cover Letter Tips Cover Letter Tips Get Reading Job Information

Sales Tax Campus Controller S Office University Of Colorado Boulder

Orbea To Move Us Operations To Boulder Colorado Pinkbike

Class Specifications Sorted By Classtitle Ascending Boulder County Careers

Sales And Use Tax City Of Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder

Orbbasic Programming Lesson 1 3 Sphero Sphero Stem Kits Connected Toys

Sample Resume For Preschool Teacher Assistant Unique Early Childhood Education Resume Samples Teacher Cv Ex Graphic Design Resume Resume Template Resume Design